do nonprofits pay taxes on utilities

Table 1-2 lists the federal taxes you may have to pay their due dates and the forms you use to report them. This chapter explains the business taxes you may have to pay and the forms you may have to file.

Profit And Loss Template For Excel Profit And Loss Statement Statement Template Profit

Most individuals operate on a cash basis which means they count their rental income as income when they actually or constructively receive it and deduct their expenses when they pay them.

. 1 per employee per pay period. W-2 workers also pay FICA taxes to the tune of 765. If youre aware of damages at the time of the roommates departure make sure to list them in the agreement.

It is included in the base subscription for Enterprise Diamond. Your deduction is limited to the portion of the expense thats actually going towards your office as opposed to. Has moved out for good and gives up any rights to the rentalincluding the right to move back in.

So youre responsible for paying both halves of your FICA taxes for a total rate of 153. If youre self-employed though your employer is well you. Wauwatosa officials on Thursday will start their review of a plan to pay for the citys about 4 million purchase of the former Boston Store connected to Mayfair mall.

If you file taxes in more than one state each additional state is currently 12month. The portion of utilities and internet used in the business may also be deducted from income. Active subscription Internet access and Federal Employer Identification Number FEIN required.

It also discusses taxpayer identification numbers. By calling the courthouse at 512-974-4800. As of the 2020 census the population was 204502 making it the second-most populous county in Mississippi.

Ultimately a compromise was struck providing direct pay to tax-exempt entities like tribes and municipal utilities while others would be able to transfer the credits. By mailing a check or money order to Austin Municipal Court PO. That acquisition closed.

In order to claim these deductions the taxpayer must conduct business to make a profit. Will pay for rent and damage no later than a stated date. Table 1-1 lists the benefits of filing electronically.

Overhead is an accounting term that refers to all ongoing business expenses not including or related to direct labor direct materials or third-party expenses that are billed directly to customers. Box 2135 Austin TX 78768-2135 with the following information. Welcome to Harrison County.

Their employers pay another 765 on their behalf. There are a few ways to pay your ticket. Online through the case portal.

For these types of costs you cant write off the entire amount you pay. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount. In short if an organization including a church receives 501c3 exemption status from the IRS it is recognition that they are exempt from federal income and property taxes.

Several utility executives. An indirect cost is something you pay for your entire home its not localized to your workspace. Harrison County is a county located in the US.

In addition people who make contributions to 501c3 organizations may deduct the contribution amount from their taxable income. On the other hand it can be difficult to compare nonprofit salaries with for-profit salaries because of the diversity of nonprofit organizations. Will pay for the appropriate share of damage to the rental unit.

Some studies such as one from NonprofitHR have found that annual turnover for nonprofits hovered in the 19 range in recent years potentially because of low pay. Most of the items listed above are indirect costs.

Electric Utilities Sector Supplement Global Reporting Initiative

Wisconsin Tax Reform Options To Improve Competitiveness

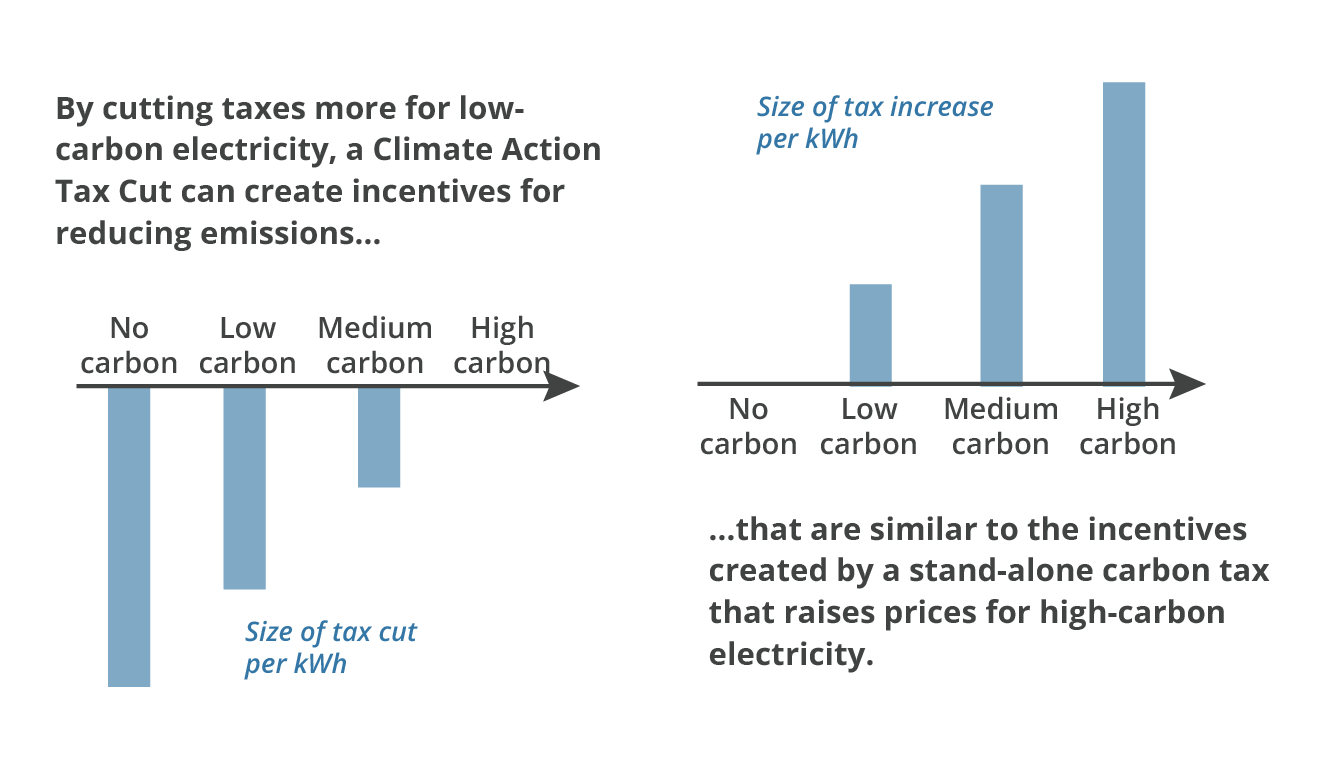

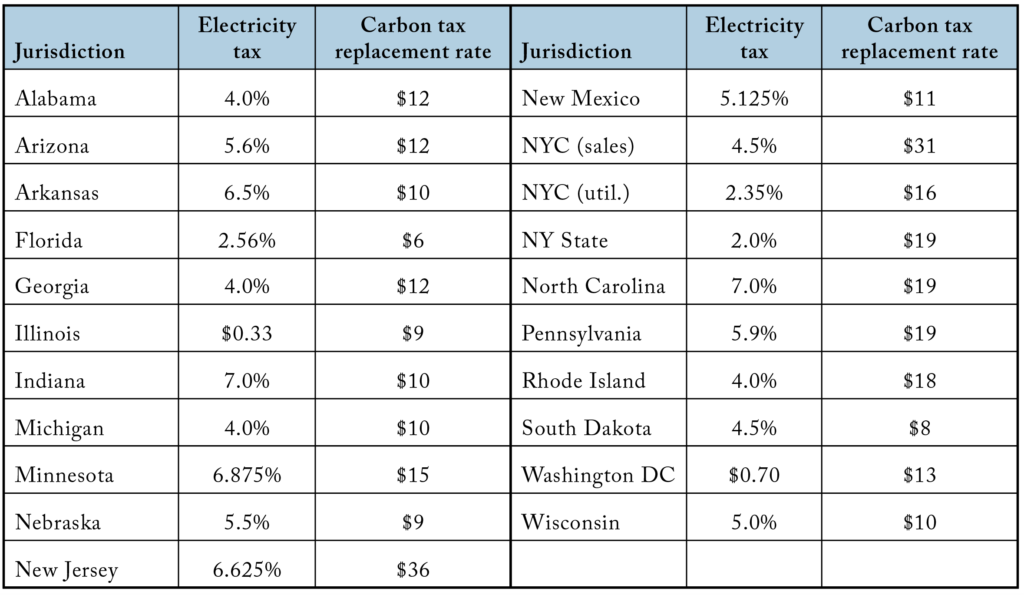

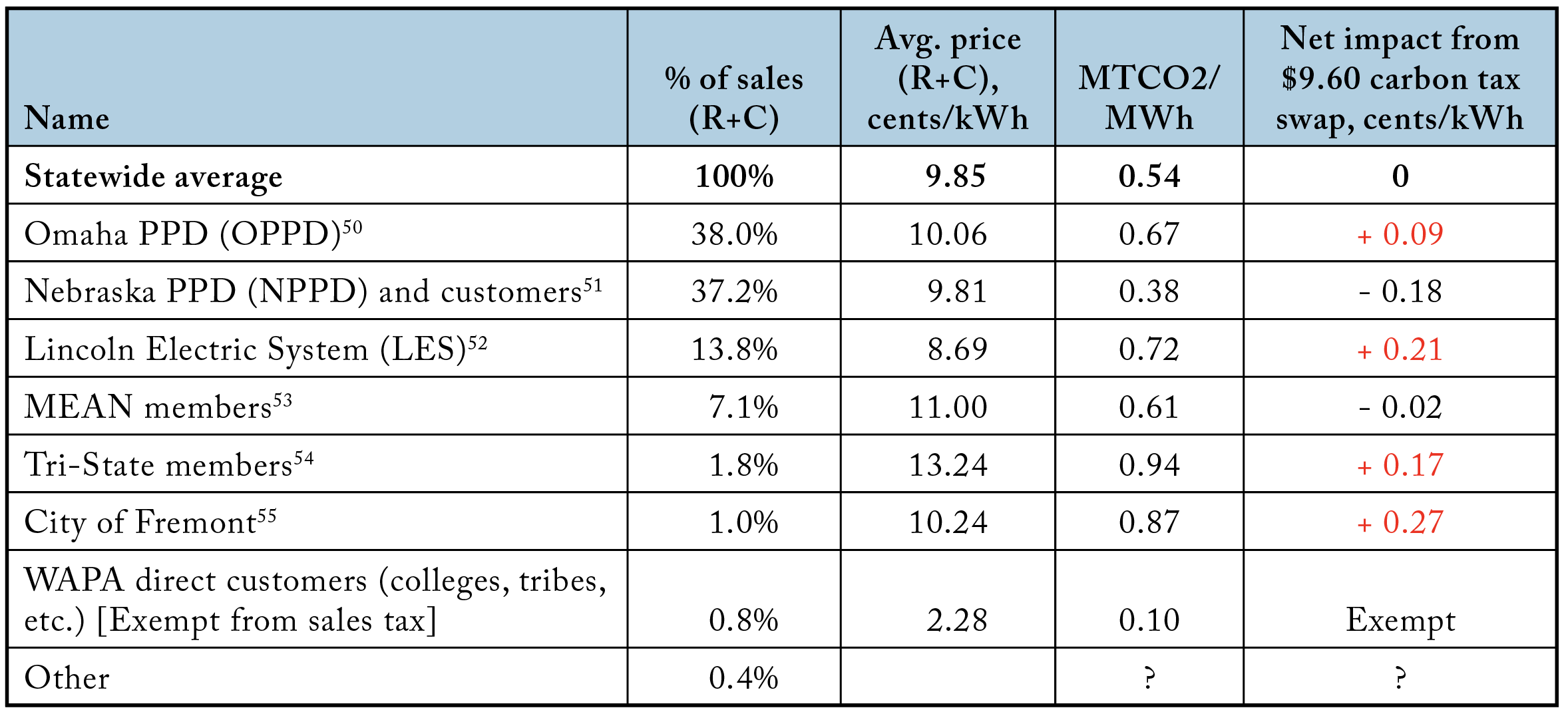

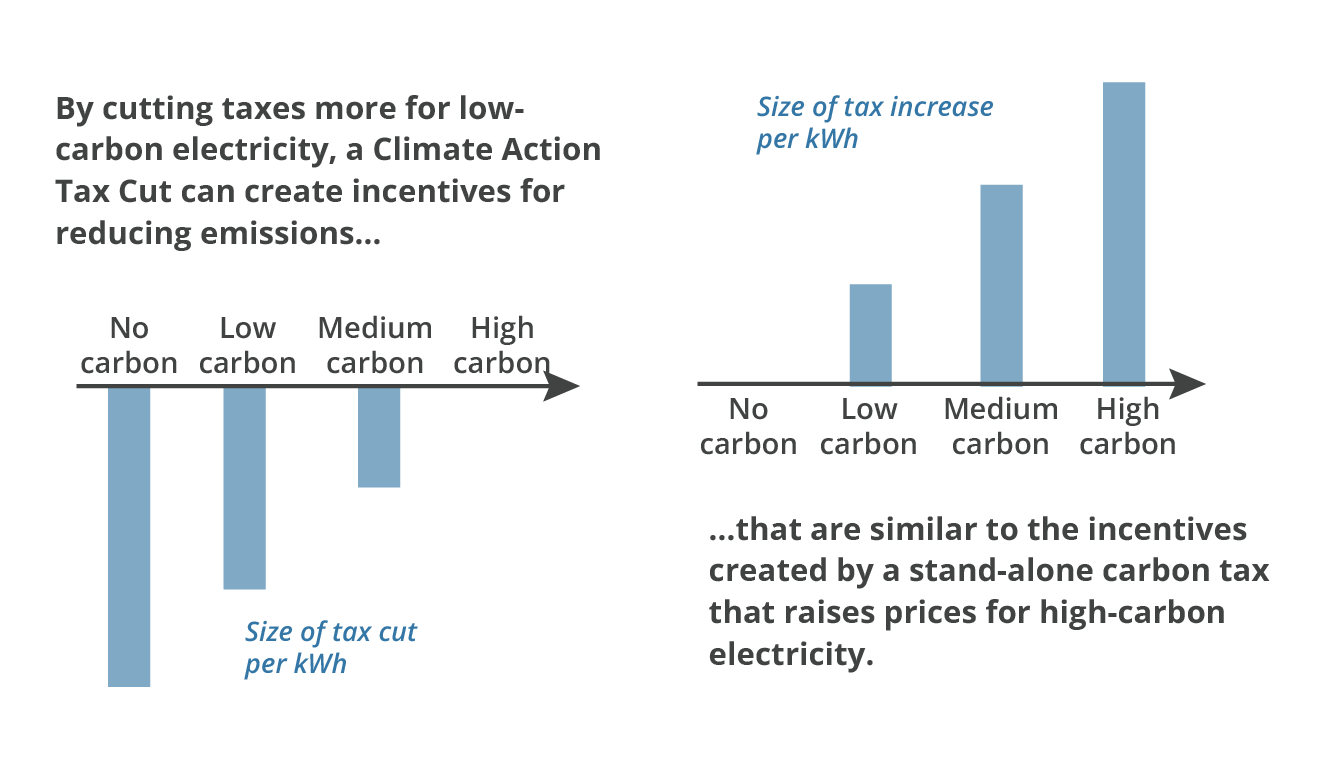

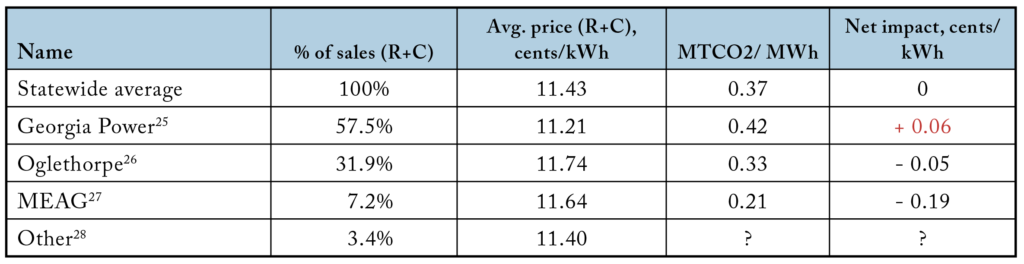

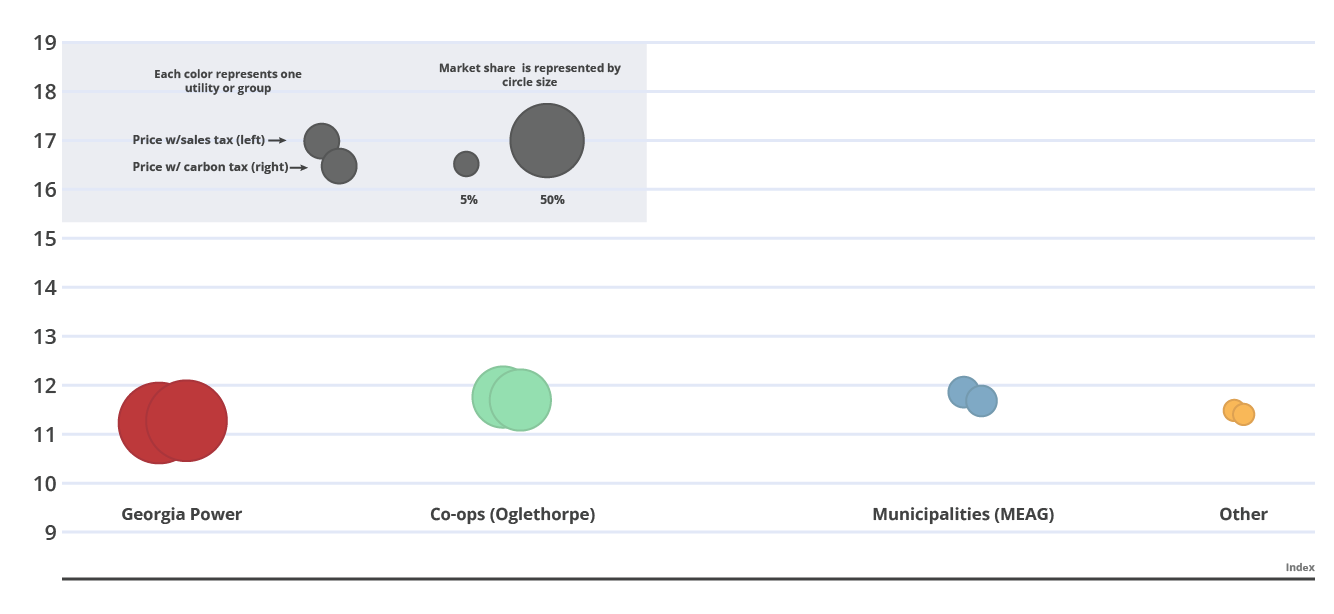

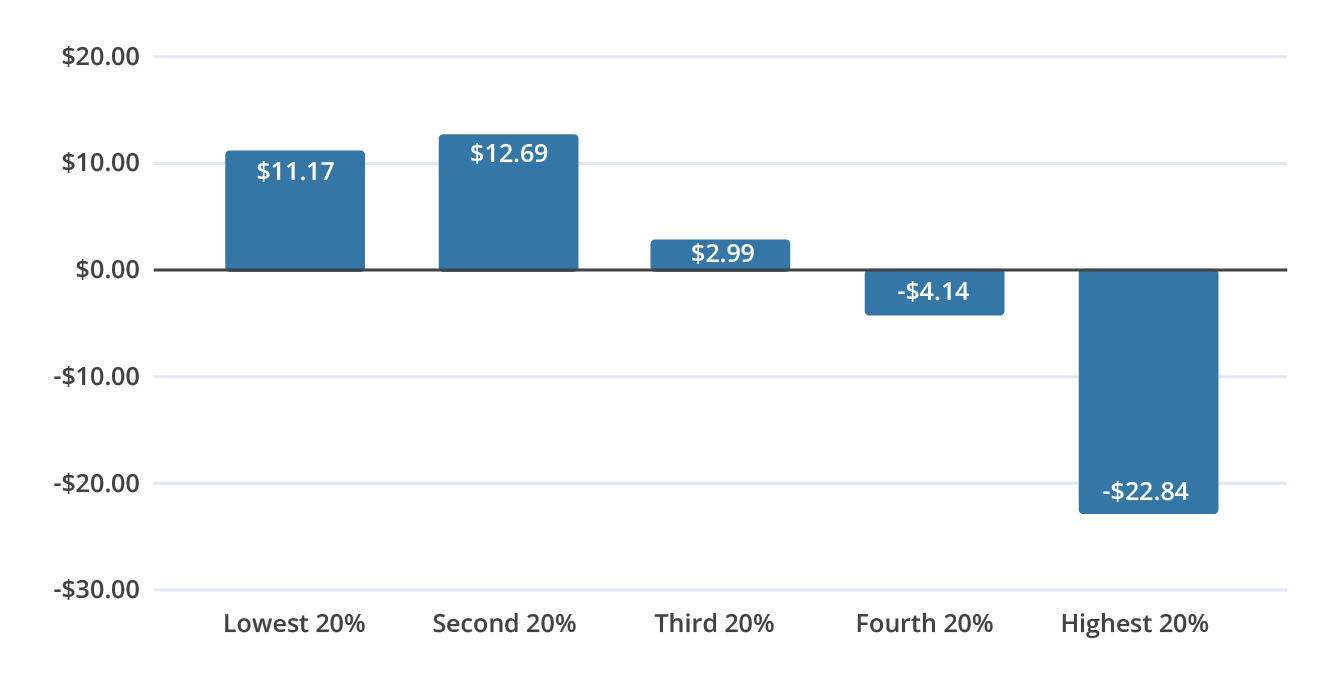

Carbon Taxes Without Tears The Cgo

Carbon Taxes Without Tears The Cgo

Carbon Taxes Without Tears The Cgo

Grant Proposal Checklist Template Budget Template Budgeting Worksheets Worksheet Template

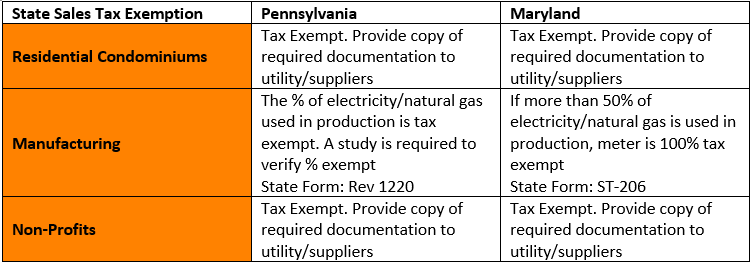

Tax Exemptions For Energy Nania

Call 211 Texas For Utility Assistance To Help You Pay The Light Bill

Free Cash Flow Forecast Templates Smartsheet Cash Flow Smartsheet Free Cash

Transportation Utility City Of Wisconsin Rapids

Tax Exemptions For Energy Nania

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Carbon Taxes Without Tears The Cgo

Houston Utility Assistance Find Help To Pay Your Light Bill 2021

Utility Payment Plans Utility Payments And Services Citybase

Carbon Taxes Without Tears The Cgo

Revenue Projection Spreadsheet Cash Flow Statement Cash Flow Spreadsheet Template

Carbon Taxes Without Tears The Cgo

Providing Essential Utility Services During Covid 19 Payments And Relief