who pays sales tax when selling a car privately in florida

Motor vehicles is 7. But a car lien may affect the auto insurance coverage youre required to carry as well as the sales process if you decide to sell your car.

Florida Vehicle Sales Tax Fees Calculator

For vehicles worth less than 15000 the tax is based on the age of the vehicle.

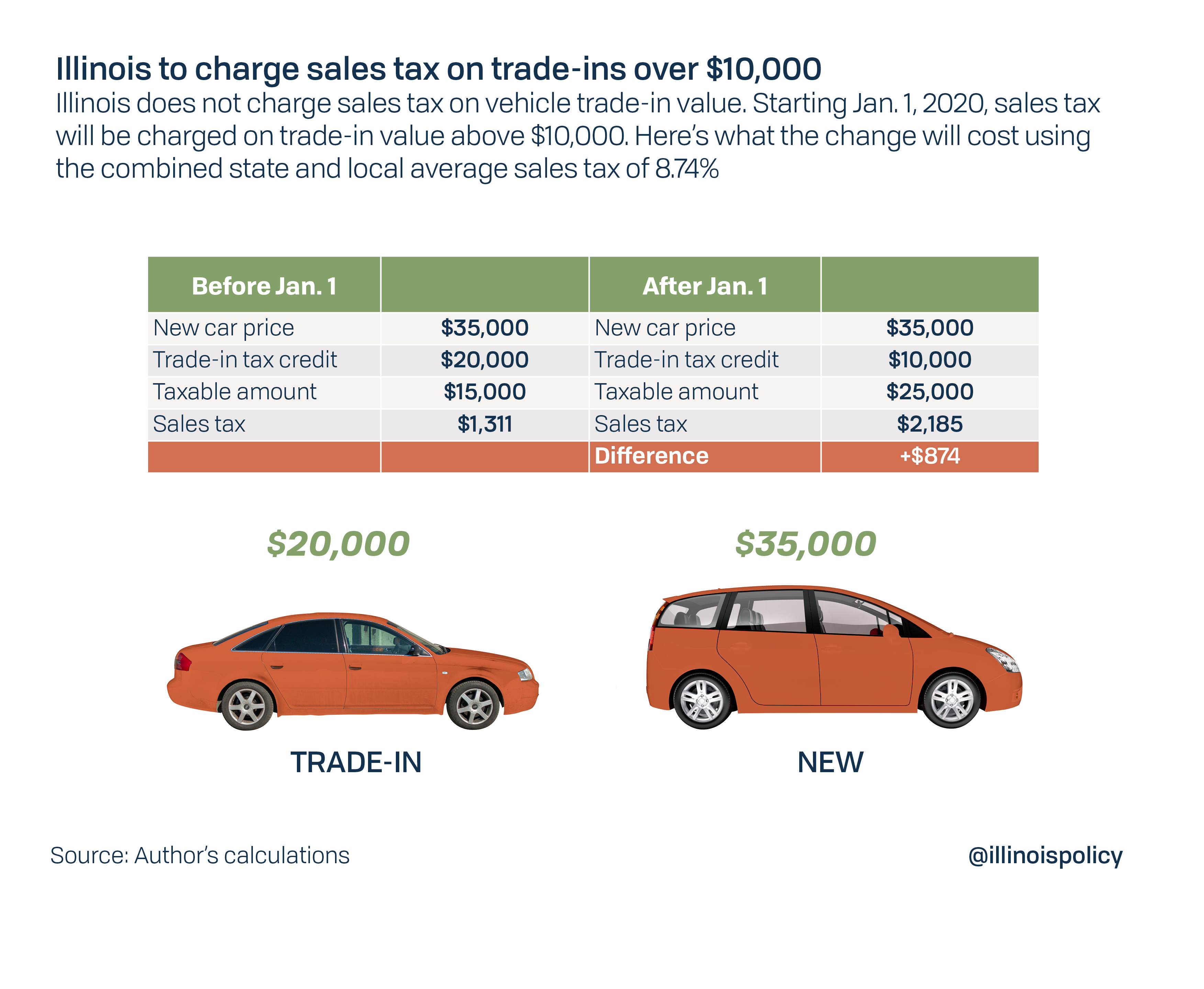

. You will pay less sales tax when you trade in a car at the same time as buying a new one. Florida collects a 6 state sales tax rate on the purchase of all vehicles. The state bill of sale or Notice of Sale andor Bill of Sale for a Motor Vehicle Mobile Home Off-Highway Vehicle or Vessel Form HSMV 82050 can be downloaded and printed.

For example if you decide to sell privately. In Florida a vehicle cannot be legally sold in a private sale if there is an existing lien. That depends on the sate and the laws regarding sales tax.

625 sales or use tax. Car buyers are likely to give you a better price vs. If youre a buyer transferee or user who has title to or has a motor vehicle or trailer youre responsible for paying sales or use tax.

If you buy a car for. Floridas general state sales tax rate is 6 with the following exceptions. No discretionary sales surtax is due.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Motor vehicle or trailer. Do I have to pay sales tax when I transfer my car title if the car was given to me.

License Plates and Registrations Buyers must visit a motor vehicle service center to register a vehicle for the first. Answer 1 of 9. In some states used car sales are sales tax free theory that sales tax collected when sold new not double taxing in.

The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. It will need to. All of the conditions that apply when buying a vehicle from an individual in a private sale also apply when buying inheriting or being gifted a vehicle from a family member.

However the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in. The buyer must pay Florida sales tax when purchasing the temporary tag. Once the lienholder reports to.

Florida collects a 6 state sales tax rate on the purchase of all vehicles. According to the Florida Department of Highway Safety its best to complete the transaction at the tax. To calculate how much sales tax youll owe simply.

You pay 1680 in state sales tax 6 of 28000. Sale of 20000 motor vehicle to a. Or private tag agency.

Florida sales tax is due at the rate of 6 on the 20000 sales price of the vehicle. For the vehicle to be legally sold the lien must first be satisfied.

/images/2022/02/08/woman_in_car.jpg)

How To Legally Avoid Paying Sales Tax On A Used Car Financebuzz

What S The Car Sales Tax In Each State Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Florida Car Sales Tax Everything You Need To Know

What Do I Do With My Plates After I Sell My Car Sell My Car In Chicago

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

Illinois House Bills Would Reverse Pritzker S Car Trade In Tax

How Do You Write A Bill Of Sale For A Mobile Home In The State Of

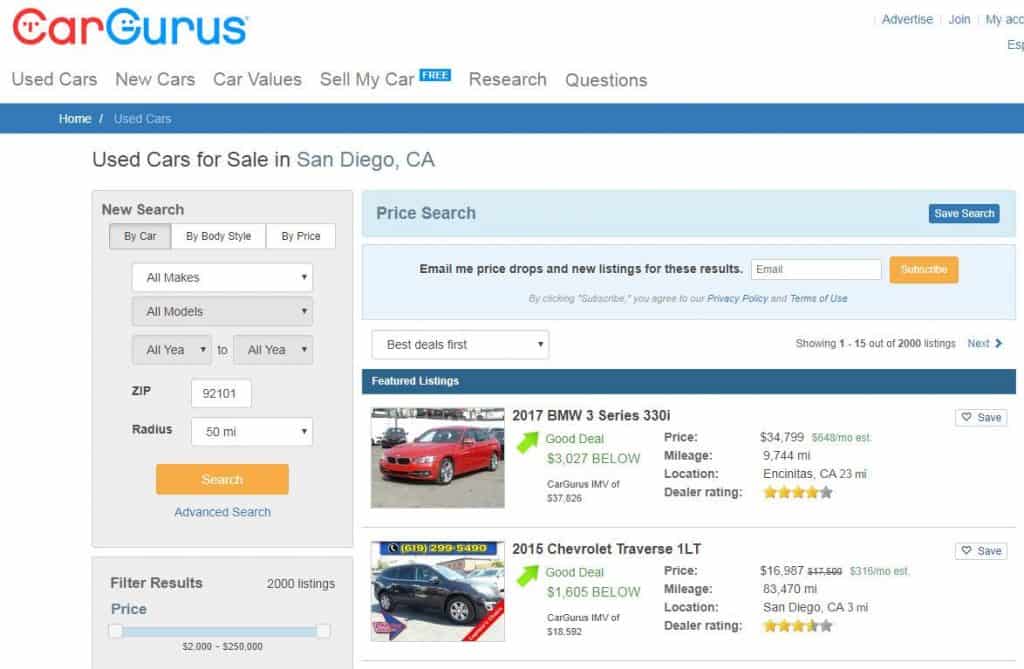

Understanding Taxes When Buying And Selling A Car Cargurus

How To Fill Out A Florida Title Youtube

Car Tax By State Usa Manual Car Sales Tax Calculator

Selling A Car In Florida Everything You Need To Know Privateauto

Free Bill Of Sale Forms 24 Word Pdf Eforms

Selling A Car In Florida A Former Dealers Advice

Free Bill Of Sale Forms 24 Word Pdf Eforms

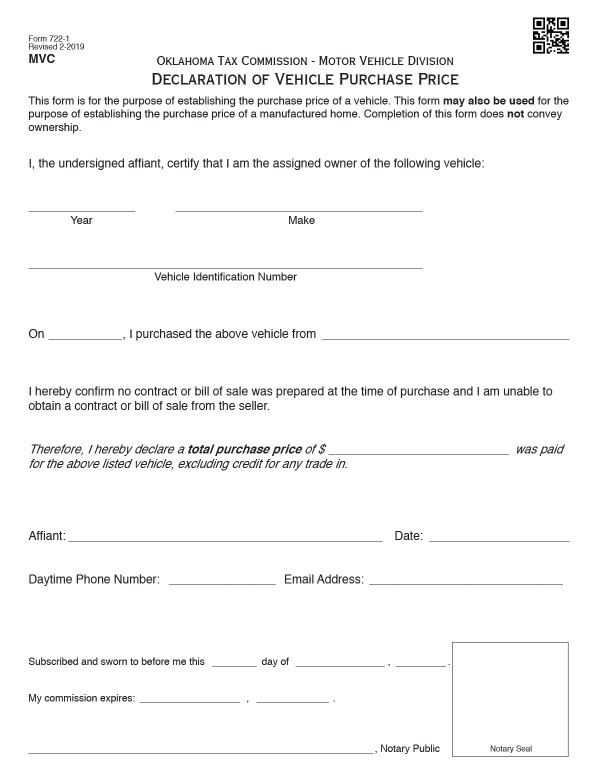

Bills Of Sale In Oklahoma The Templates Facts You Need

Do I Need To Pay Taxes On Private Sales Transactions Rocket Lawyer